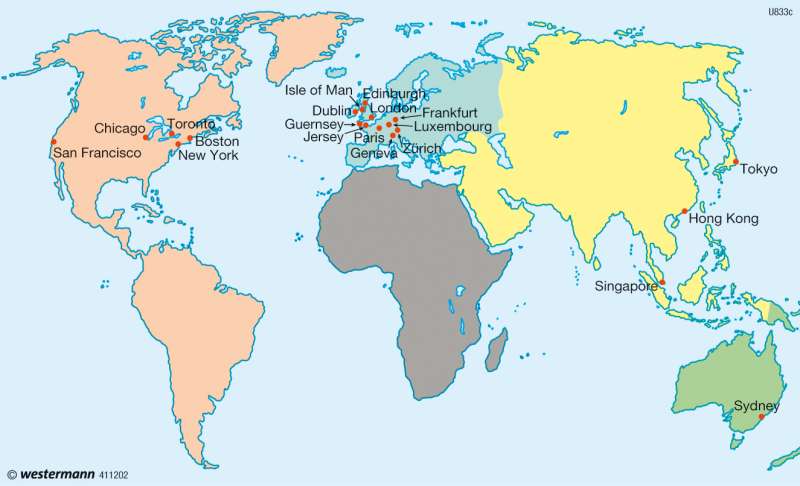

The world's largest financial centres

London and Paris - Global cities

978-3-14-100790-9 | Page 69 | Ill. 7

Information

Generally, there is no official standard way for ranking the world's most important financial centres. Often, these companies can be worked out using indicators by which a corresponding infrastructure can be determined.One of the newest and most comprehensive standards for such a ranking is provided by the Global Financial Centres Index (GFCI), which has been published twice a year since 2006. It brings together approximately 60 indexes for each site, taking into account, amongst other things, training of employees, business environment, access to financial markets and overall competitiveness. It covers over 25,000 questionnaires as well as the tax environment, vulnerability to corruption and quality of life. These indexes are combined with current economic statistics in order to produce a comprehensible and traceable ranking.

Top ten of the financial centres

At the end of 2009, London was in first position as the most important international financial centre. The only other European cities represented and positioned in the top ten were both Zurich and Geneva in Switzerland.

London was followed in the ranking by New York, the second U.S. city represented was Chicago. The five remaining major global financial centres were Asian cities: Hong Kong, Shenzhen and Shanghai in China, the Japanese capital Tokyo and the Southeast Asian city-state of Singapore.

The map has a different distribution in Asia, where Shenzhen and Shanghai are missing, as it is based only on the GFCI No. 5. Also, the Asian financial centres are undergoing rapid, dynamic developments. The annual growth rate of real gross domestic product, which is projected from 2006 to 2020 can be read in the example. Accordingly, the rate is at two (%) percent among established financial centres like New York or Tokyo, while it is estimated at 6.5 (%) percent for Shanghai.

Spatial distribution

If we take not only the ten, but the top 20 financial centres, the result is agglomerations which have a total of eleven locations in Europe. Below that is Frankfurt, Germany's prominent banking and financial centre. Besides London, Paris is positioned as the only other world city in Western Europe. That not only metropolitan areas offer excellent conditions for international financial markets, the Isle of Man as well as the two Channel Islands of Jersey and Guernsey show that a big part of their economic performance is achieved through financial services and as tax havens which attract capital. The metropolitan areas of San Francisco, Tokyo and Hong Kong dominate the Pacific market, while Singapore and Sydney are the most important centres in Southeast Asia and Oceanic regions.

D. Falk; Ü: C. Fleming